THIS ISSUE OF WDODTW IS SPONSORED BY:

You’ve built momentum. We turn it into market value.

Strategic communications for tech businesses scaling between Series A and C.

Book your free Narrative Audit and sharpen the story behind your growth.

Follow us on LinkedIn for insights on sharpening your story.

A BILLION DOLLAR IPO ISN’T COOL, YOU KNOW WHAT’S COOL? A TRILLION DOLLAR IPO.

OpenAI crossed a line few thought possible. The company that began as a research collective has re-emerged as a trillion-dollar contender, preparing what could become the largest IPO in modern history. The transformation from capped-profit lab to full corporate entity is complete. A new legal structure, new governance model, and clear political positioning mark the end of OpenAI’s experimental phase and the start of its imperial (possibly dark sided) one.

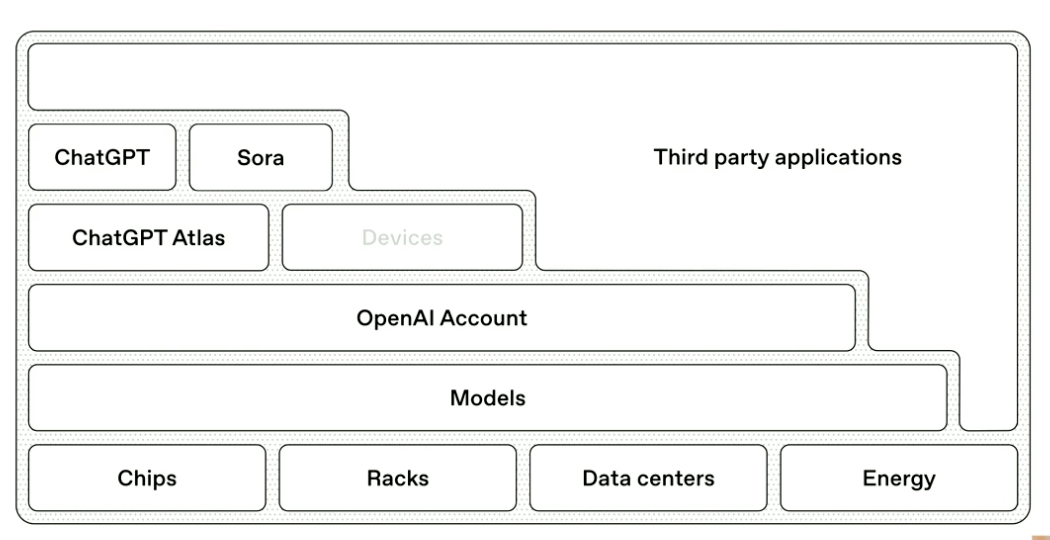

Restructuring the company required precision; the old hybrid structure, half nonprofit, half commercial, is dissolved and replaced with a foundation that controls the operating business beneath it. A fresh governance model grants investor liquidity while keeping a symbolic layer of oversight intact. Sam Altman removed himself from any equity position to pre-empt accusations of self-dealing and to reinforce the public image of altruistic capitalism. Microsoft expanded its stake to 27% and secured exclusive model access through 2032, effectively ensuring that OpenAI’s future is bound to Azure’s infrastructure and Microsoft’s enterprise machine. Here’s what the new half non-profit looks like:

Regulatory hurdles in California were cleared after OpenAI promised to remain headquartered in the state and maintain domestic board control (kudos to Newsom on that one). The concession unlocked approval for the restructure and silenced political resistance that had threatened to delay an IPO. The resulting entity behaves like a public-benefit corporation in everything but name: commercial in operation, moral in branding. Investors gain exposure to a company selling intelligence at planetary scale; regulators face a corporate ghost that claims social purpose while acting with the discipline of a sovereign fund.

Momentum behind the listing is already visible. OpenAI’s Stargate expansion into Michigan signals the next phase of hardware accumulation, positioning compute as the new oil. Microsoft’s quarterly earnings confirmed OpenAI’s contribution as a driver of Azure growth, offsetting heavy infrastructure losses. ChatGPT’s 800 million weekly users and the surging enterprise adoption rate have transformed the platform into the world’s most valuable distribution network for language models. Investor expectations are built on velocity, not novelty. Scale itself has become the moat.

Litigation still circles but has lost its teeth. Elon Musk’s attempt to unwind the restructure, author lawsuits over data use, and Cameo’s trademark claim around Sora’s features all function as background noise. None appear capable of slowing the IPO timetable. The market sees legal risk as reputational, not structural. Altman’s trillion-dollar rhetoric once sounded inflated; now it defines the horizon investors are preparing to finance.

A public listing supplies what OpenAI lacks most: capital for compute. Model training now consumes more electricity than national grids can easily supply. Altman calls energy a “strategic asset,” and the IPO funds the industrial infrastructure required to generate it. OpenAI’s pitch is not another growth story, it is a plan to own the architecture of intelligence itself.

SO WHAT?

OpenAI’s IPO formalises artificial intelligence as a national asset class. The company has fused moral narrative with monopoly economics, embedding a foundation structure that disguises centralisation as virtue. Anchoring the company in California and deepening alignment with Microsoft delivers both legitimacy and leverage. The new structure lets OpenAI appear mission-driven while behaving like a vertically integrated power utility for cognition.

Competitors will now operate under OpenAI’s gravitational pull. Anthropic remains a moral alternative without comparable scale, and Google faces an identity crisis as its AI business fragments across products. Policymakers confront a harder question: how to regulate a company that now controls the technical, financial, and ideological infrastructure of AI. The OpenAI IPO (when here) is not a fundraising event, it’s declaring jurisdiction, and OpenAI’s foundation is a corporate firewall, not a citizen board. The walls have been fortified, expect a bolder OpenAI to emerge.

Field Notes

ANALYST/ADVISORS

Do: Treat OpenAI’s restructure as the prototype for future AI IPOs; expect similar foundation-led governance hybrids across the sector.

Don’t: Assume traditional valuation models apply, compute capacity and energy contracts now drive equity logic.

ENTERPRISE

Do: Track how Microsoft’s 27% stake translates into product exclusivity and pricing leverage.

Don’t: Expect open access to new model tiers; integration will follow partnership capital flows, not developer demand.

TECH/DEVELOPERS

Do: Prepare for downstream cost shifts as compute-intensive APIs reprice post-IPO.

Don’t: Build dependencies on subsidised endpoints; OpenAI’s public status will tighten usage economics.

BRAND/COMMS

Do: Frame OpenAI partnerships as alignment with national-scale infrastructure, not vendor relationships.

Don’t: Overplay the moral narrative, investors and regulators increasingly view “benefit” branding as optics.

COMPANY ↓

OpenAI, staff/leadership profiles, board & governance, mission & values, HQ & global offices, funding rounds & investors, financial health & revenue, partnerships & alliances, organisational structure & hierarchy, regional presence & expansion

OpenAI confirmed its intent to remain headquartered in California, satisfying state regulators and facilitating its corporate restructuring ahead of an IPO. / WSJ

Sam Altman laid out the new structure and did a long, live Q&A. / OpenAI

OpenAI finalised a new corporate structure creating a nonprofit foundation parent and a for-profit subsidiary, laying the groundwork for a public listing. / FT

OpenAI stated that litigation by Elon Musk would not reverse its corporate restructuring. / The Information

OpenAI was sued by Cameo for alleged trademark infringement over the “Cameo” feature in its Sora app. / Reuters

OpenAI prepared for an IPO targeting a valuation near one trillion dollars following its restructure. / Axios

Microsoft secured a 27 percent stake and long-term access to OpenAI models until 2032. / Bloomberg

OpenAI and Microsoft renewed their partnership, expanding shared research and cloud integration. / Microsoft Blog

OpenAI published a corporate essay emphasising its mission to build AI “to benefit everyone.” / OpenAI

OpenAI stated that CEO Sam Altman would not take an equity stake in the restructured firm. / Reuters

OpenAI expanded office space in Mountain View to accommodate rapid hiring. / BizJournal

TECHNOLOGY ↓

ChatGPT ecosystem, DALL·E tools, Whisper audio, product roadmap, prototypes, developer access, integrations, extensions, research, innovations

OpenAI introduced “Aardvark,” a GPT-5-based autonomous cybersecurity research agent. / ZDNet

OpenAI detailed technical documentation for GPT-OSS Safeguard. / OpenAI

OpenAI updated system cards for GPT-5 focusing on sensitive conversations and transparency. / OpenAI

OpenAI published improvements to ChatGPT’s handling of sensitive dialogue topics. / OpenAI

OpenAI launched “ChatGPT Atlas,” a new architecture supporting multi-modal context and reasoning. / OpenAI

OpenAI expanded its Stargate data-centre project to Michigan to increase model-training capacity. / OpenAI

OpenAI added paid Sora credits and planned limits on free video generations. / Engadget

OpenAI’s Sora app was updated with new “Character Cameo” functionality. / The Verge

OpenAI made Sora accessible in the US without an invite. / CNET

OpenAI offered ChatGPT Go free for a year in India to drive adoption. / Reuters

OpenAI’s ChatGPT release notes documented multiple product updates through October 2025. / OpenAI Help

STRATEGY/IMPACT ↓

Public Policy, CSR, ESG practices, ethics & AI safety, risk management, competitive strategy, thought leadership, industry impact, market positioning & competitive strategy

OpenAI prepared a “juggernaut IPO” plan projecting a trillion-dollar valuation. / Reuters

Sam Altman outlined OpenAI’s long-term vision for global AI scale and sustainable energy-intensive growth. / Reuters

OpenAI’s leadership stated that Musk’s legal challenge would not derail its structure. / Bloomberg

OpenAI’s growth was compared with Meta’s underperformance in investor sentiment reports. / CNBC

OpenAI partnered with PayPal to integrate ChatGPT for direct payment and checkout experiences. / CNBC

OpenAI responded to safety concerns with a detailed defence of its guardrails for ChatGPT. / NYT

OpenAI joined Amazon and Cal State to provide AI resources for education initiatives. / NYT

OpenAI predicted that researcher tasks would be fully automated by 2028. / eWeek

OpenAI increased hiring across India to support local startups and product growth. / Economic Times

OpenAI dismissed part of a US authors’ copyright lawsuit but remained subject to other claims. / Reuters

OpenAI’s growing influence led analysts to call it “too big” to challenge meaningfully in generative AI. / Yahoo Finance

OpenAI was highlighted as a key contributor to Microsoft’s Q1 2026 results. / CNBC

OpenAI’s partner Crusoe Energy reached a $10 billion valuation, supported by OpenAI-related infrastructure demand. / Bloomberg

OpenAI’s internal deposition revealed prior merger talks with Anthropic and internal disputes. / The Information

OpenAI explored additional private investment sources for upcoming growth phases. / The Information

OpenAI’s scale ambitions were analysed as shifting from innovation hype to corporate discipline. / Reuters Breakingviews

OpenAI argued that US–China AI power competition required balanced export policy. / CNBC

OpenAI participated indirectly in Apple’s AI merger speculation discussions. / WebProNews

OpenAI’s founder reflected that he wished he had received earlier equity ownership. / Business Insider

OpenAI was criticised by Japanese IP groups for alleged unauthorised training on major entertainment IPs. / IGN

OpenAI was named in additional author lawsuits including claims from George R. R. Martin. / The Gamer

OpenAI faced scrutiny over financial losses reported in Microsoft’s earnings linked to revenue-sharing costs. / The Register

OpenAI’s market strategy was analysed by Yahoo Finance as positioning for trillion-dollar scale. / Yahoo Finance

OpenAI’s CEO Altman made light of Elon Musk in a Tesla Roadster comment online. / Unilad Tech

OpenAI’s brand became part of the “6-7 Trend” slang on TikTok, blending Gen Alpha humour with ChatGPT. / Business Standard

OpenAI opposed aspects of proposed Google Search remedies, arguing they restrict innovation. / Law360

OpenAI reiterated that Google’s search remedies would curb AI competition. / Global Competition Review

MISCELLANEOUS ↓

Legal, scandals, industrial action, revenue, profiles, public policy, CSR, ESG, corporate culture, ethics, risk management, Sam Altman investments, +

RESOURCES ↓

POVs, data visualisations & dashboards, key insights & metrics, industry reports & white papers, competitive analysis, recommended reading & book lists, analysis pieces & case studies +

OpenAI urged the United States to build 100 gigawatts of new power-generation capacity annually, describing electricity as a strategic asset in the AI race with China. / Tom’s Hardware

How AI-driven analytics and dashboards are transforming enterprise decision-making and real-time data insight practices. / Learning People

Not subscribed yet?

Join the thousands who are getting updated every week.

Try it for a month. Cancel anytime.